Residential real estate segment for low-income people: This is still a segment with great demand, but investors are not interested in putting money in, because the profit margin is very low. For this segment to develop, it is necessary to have Government encourage investors, and banks to invest more in the housing segment for low-income people. This segment is currently in need of a lot of capital, but Vietnam's financial system is pouring money into this segment very slowly. Therefore, the development level of this segment is relatively low in 2021.

High-end real estate segment: In Ho Chi Minh City, expected supply in the second half of the year will be mainly in the high-end and luxury segments, townhouses and villas located in complex projects and urban areas.

Currently, there are very few new projects, and 10 projects are temporarily suspended for sale to adjust prices.

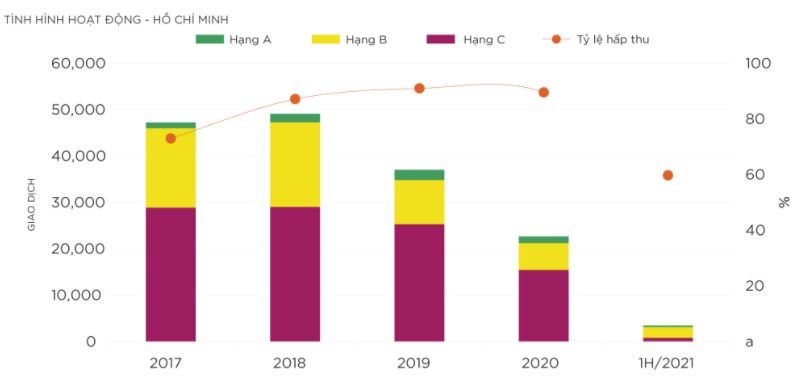

Quarter 2 of 2021 has the lowest transaction volume and absorption rate in the past 5 years. Total transaction volume decreased -36% YoY, down -5 percentage points QoQ.

Selling price is maintained equal to or higher than in 2020. However, supply is very limited, primary supply is down -25% QoQ.

Apartments have always been the type that has received a lot of attention because serving mostly real needs. Althought there are areas where prices have dropped by 20-30%, but the apartment segment is still the hottest focus. This is a product that is highly sought after by many investors with its price trend continuously increasing over time.

In terms of location, the market will expand further from the center to township projects along with key infrastructure projects. Furthermore, investors in the South will look for more opportunities in the Northern provinces.

Office building segment:

Unsurprisingly, supply has been on a downward trend since Q2/2020 due to limited rental demand during the Covid pandemic, down -1% QoQ and -3% YoY. Average rent decreased -4% QoQ, Grade B rent fell the most, homeowners are offering many incentives such as discounts, added utilities for long-term contracts.

This segment in 2021 has two trends: (i) focusing on projects that are able to recover, projects with favorable locations and (ii) with projects that If there is no prospect, new projects born in unfavorable locations will face difficulties and be temporarily hibernated.

SUM UP

Apartment for living purpose in low-income market is high demand but the profit margin is not attractive. Trend is focusing on high-end and luxury condominiums which is safety long-term investment.

Office for rent has been delayed by epidemic prevention plan of Vietnam government, however, to be ready for next chapter of business recover once COVID-19 vaccine applied popularly.